Sherlock Lending at a Glance

With the advent of e-commerce, digital payments and digital transformation at large, application fraud cases in the Lending industry have become a common sight. Estimated digital fraud losses are staggering and can negatively impact business performance. It is advisable to mitigate fraud risk from the start with an application fraud detection solution. So how do you demotivate fraudsters from targeting your financial institution?

Sherlock is an innovative automated fraud detection tool launched by India’s leading RBI authorized consumer credit bureau CRIF High Mark.

Fraud Detection

AI Techniques

Multiple Verifications

Protect your lending business from the risk of application fraud with Sherlock.

Contact UsSherlock Lending to the Rescue - Discover Our Complete Anti Fraud Solution Suite

- Looking beyond Identity Verification Simplify Customer Onboarding

- Fraud Index-Reduce the risk of threats

- AML Check-AML screening and monitoring

- Anomaly detection- Automatic anomaly detection

- New Account Fraud Prevention-Fight fraudulent account opening

Looking beyond Identity Verification Simplify Customer Onboarding

Identity fraud is a serious threat to any business. Sherlock has an automated process to verify government-issued Identity documents in real time. Now perform end-to-end validation checks with ease.

Fraud Index-Reduce the risk of threats

Nunc dui velit, scelerisque eu placerat volutpat, dapibus eu nisi. Vivamus eleifend vestibulum odio non vulputate.

AML Check-AML screening and monitoring

Nulla eleifend felis vitae velit tristique imperdiet. Etiam nec imperdiet elit. Pellentesque sem lorem, scelerisque sed facilisis sed, vestibulum sit amet eros.

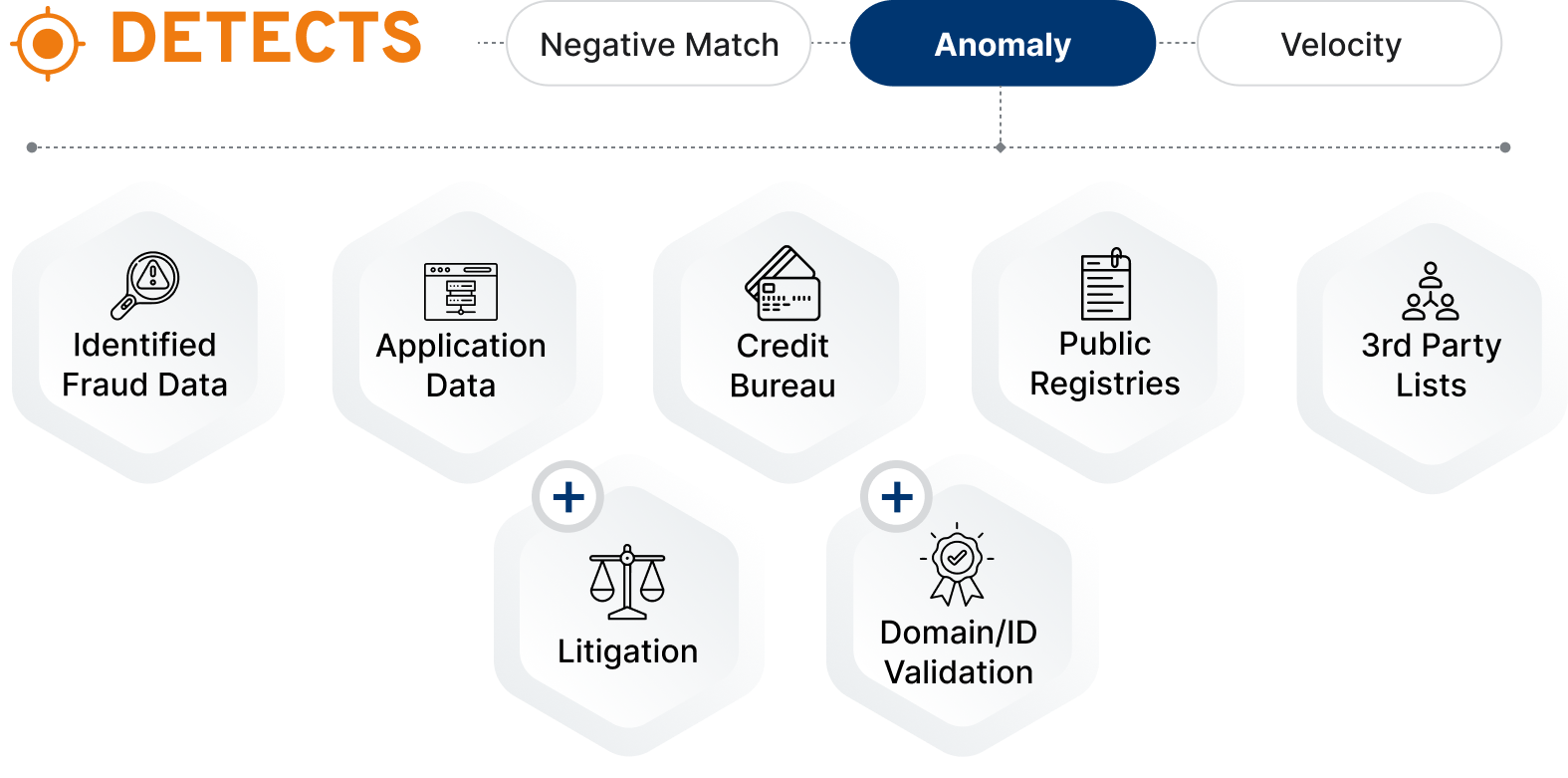

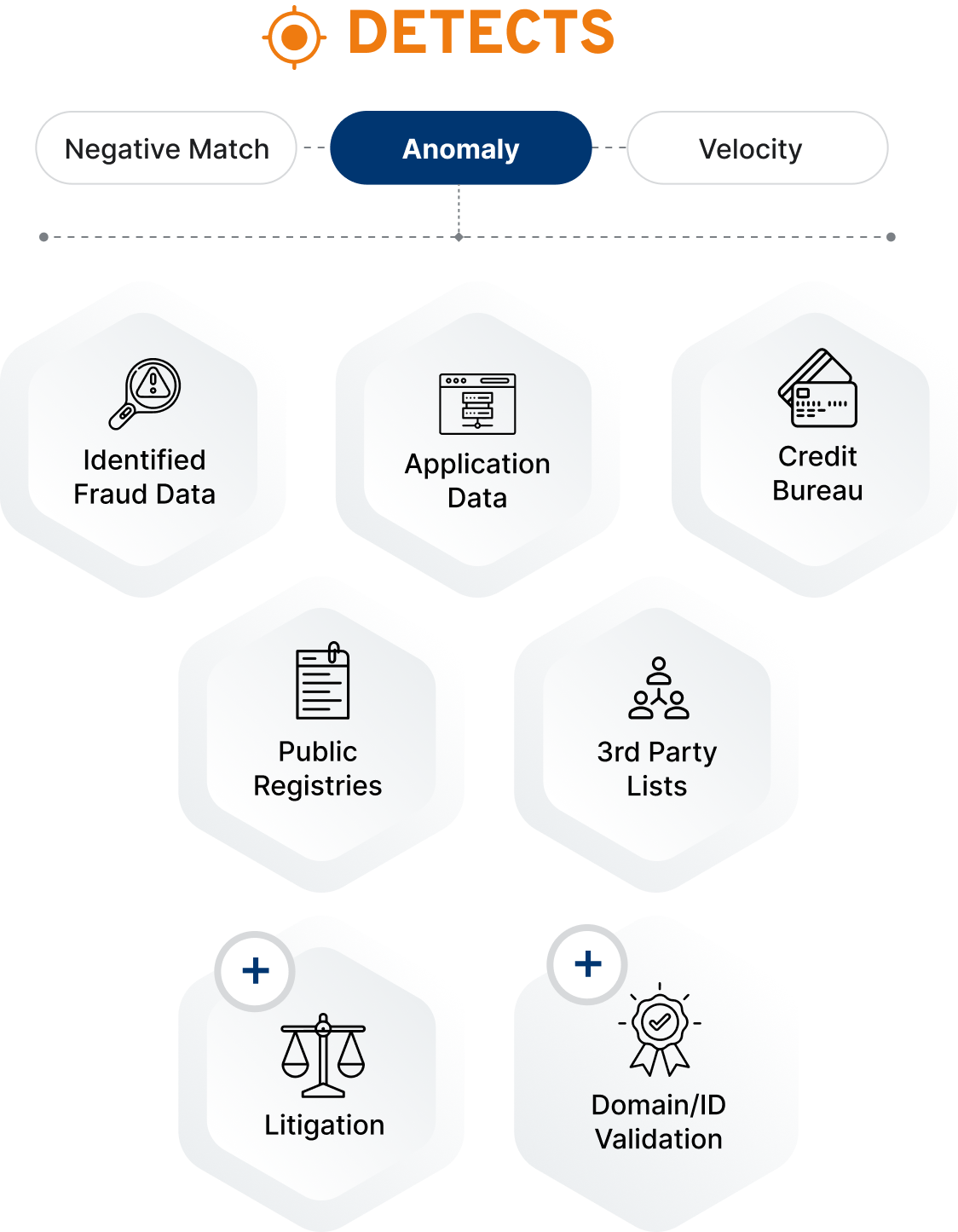

Anomaly detection- Automatic anomaly detection

Integer ultrices lacus sit amet lorem viverra consequat. Vivamus lacinia interdum sapien non faucibus. Maecenas bibendum, lectus at ultrices viverra, elit magna egestas magna, a adipiscing mauris justo nec eros.

New Account Fraud Prevention-Fight fraudulent account opening

Integer ultrices lacus sit amet lorem viverra consequat. Vivamus lacinia interdum sapien non faucibus. Maecenas bibendum, lectus at ultrices viverra, elit magna egestas magna, a adipiscing mauris justo nec eros.

How can we help you?

While you focus on Growth, we focus on your Protection

Protection from financial losses

Save time and money wasted in manual fraud process detection

Strike the right balance between secure and frictionless customer experience

Automatically block fraudulent applicants, before they attack your business

Provide uniform recommendations on the next course of action, once fraud is detected

Enrich the decision making system with real time analytics and Increase the speed of interventions

Sherlock Lending

A trusted partner to protect your business

Lorem Ipsum is simply dummy text of the printing and typesetting industry.

Contact Us

Why Choose Sherlock Lending for application fraud prevention?

- Top-notch Fraud detection technology that protects your lending business from application fraud

- Reduces false positives to improve the catch rate

- Customizable Fraud protection parameters

- Clear acquisition analytics to take fully informed decisions

- Real-time Fraud detection and monitoring with Machine Learning

- Assisted Investigation on the suspected flags

- Can be easily embedded and integrated into your workflow

- Lower review time for suspicious cases

- Vast & ever expanding data network

Let's Talk About

Our Products and Services

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since